Newsletter

Financial Wellness Starts Here

← 017 Neontra Newsletter Issue #016 015 →

Estimated reading time: 6 minutes

Did you know?

Canada had a 25-cent banknote known as the "shinplaster" that first appeared in 1870. It was in circulation for about 65 years as the intrinsic value of metal rose above the value of coins.

Learn more about Canadian 25¢ banknote known as a "shinplaster" →Word of the week

Essential Expenses

These are expenses that are necessary. Another way to identify these expenses is to determine if they are 'needs' rather than 'wants'. Essential expenses might include: - Rent/Mortgage - Groceries - Utilities - Medical Expenses Unlike, restaurants, and entertainment, that are 'wants' or non-essential expenses and do not need to be made.

Follow every dollar - Track and analyze your non-essential expenses →Budgeting

What Is Kakeibo? Kakeibo, pronounced “kah-keh-boh,” translates as “household financial ledger.” Invented in 1904 by a woman named Hani Motoko (notable for being Japan’s first female journalist), kakeibo is a simple, no-frills approach to managing your finances.

‘Kakeibo’: The Japanese method of saving money →Quote of the week

"Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this."

- Dave Ramsey

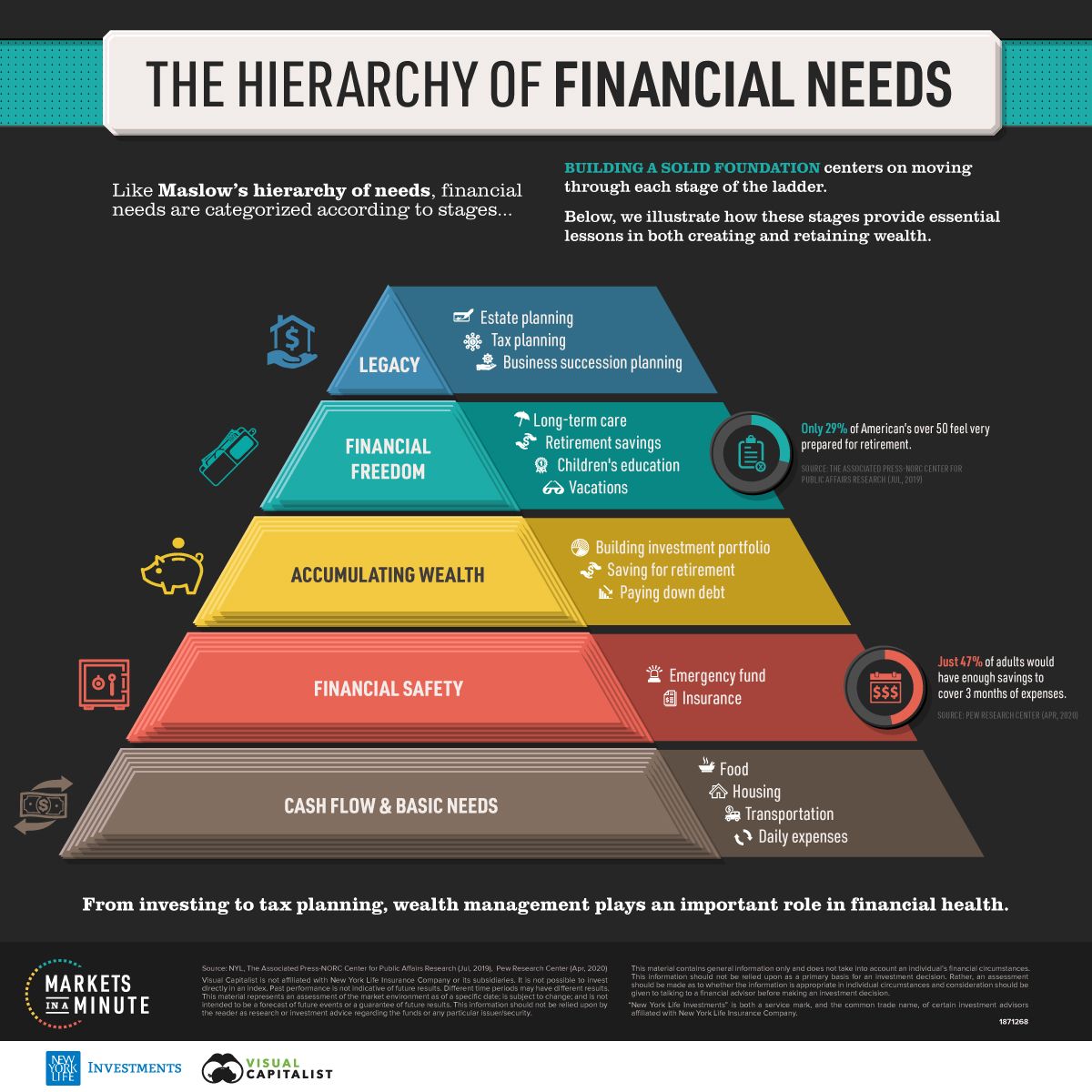

Infographic of the week

Visualizing the Hierarchy of Financial Needs

Behavioural scientist Abraham Maslow wrote “A Theory of Human Motivation” in 1943, arguing that humans worldwide are influenced by a “hierarchy of needs”. This theory organizes human needs across five levels, where needs in the lower end must be satisfied before progressing onto the next level.

See the steps to creating a strong financial foundation →

See the steps to creating a strong financial foundation →Saving

Rob Carrick talks to Paul Kershaw, a professor at the University of British Columbia and founder of Generation Squeeze, a group that researches intergenerational fairness, about why many millennials feel like the middle class is dead.

Podcast: Is the middle class dead for millennials and Gen Z? →

Podcast: Is the middle class dead for millennials and Gen Z? →Investing

Financial advisors agree: These are the 3 best investing tips for beginners

CNBC Select shares three tips for any beginner investor just starting out. 1) Audit your finances before you even start to invest 2) Utilize retirement accounts as much as you can 3) Know you don’t have to be an expert

If you’re just getting into investing, read more →Serious stuff

Learn the 101 of financial literacy with a fun, dynamic guide that makes money feel empowering, financial literacy becomes a life-long habit that pays dividends.

Financial literacy 101 from the Canadian Foundation for Economic Education →Fun stuff

"I just got paid today Got me a pocket full of change Said, I just got paid today Got me a pocket full of change"

Which artist is #1 on our Neontrack playlist this week?

Listen to our Neontrack playlist when you have music and money on your mind.