Personal Finance

Better Finances for a Better You

Topic: "Financial Wellness"

← Curating the web to find the most interesting and helpful

information about your money.

Serious stuff

Six smart ways to help boost your financial wellness

Make saving easier and help reduce financial stress by considering these steps →Infographic of the week

Financial wellbeing is the top challenge faced by employees, yet employers struggle to address this issue

Financial health is the top wellbeing concern for employees, but many employers acknowledge a gap in effectively addressing this issue.

Saving

How to make sure you’re taking advantage of all employer benefits to boost your wealth by Carmen Reinicke

Many employers offer their workers benefits beyond just health insurance and retirement planning →Serious stuff

Travel without financial stress. While there are numerous ways to travel without straining your budget, some individuals lack financial literacy, while others tend to overextend their finances.

Why Good Financial Wellness is Important While Traveling →Serious stuff

College is a perfect time to put financial know-how to the test. Here's how parents can set their kids up for success by making smart money choices.

Finance 101: Money Skills Every New College Student Needs →Serious stuff

Does money buy happiness? Though this seems straightforward, previous research has yielded contradictory findings, leaving uncertainty about its answer.

Does Money Buy Happiness? Here’s What the Research Says →Budgeting

I Write About Money for a Living and Swear by These 7 Budgeting Tips by Kelly Ernst

You don't have to spend years deep-diving into budgeting to manage your money better. All you need are these essential tips. →Serious stuff

Money mindfulness: Four questions to ask yourself before buying to stay on budget

Money and Mindfulness: Questions to Ask to Stay on Budget →Budgeting

You might be wondering how much you should spend within each of your budget categories. Unfortunately, there is no right amount to spend in any category for every individual. It's up to you to decide what works for you. There are a variety of philosophies about the best way to budget.

Popular Budgeting Strategies from Financial Wellness @ Penn →Serious stuff

You don’t have to achieve financial peace of mind all at once, but budgeting, setting goals, protecting against risk and saving for retirement can get you there.

Four Tips to Get Your Financial Wellness in Shape by Salene Hitchcock-Gear →Serious stuff

Watch to learn about six personal finance topics that can have a big impact on your life: budgeting, saving, debt, taxes, insurance, and retirement.

Managing Money: Six Principles of Personal Finance from Charles Schwab →Word of the week

Financial Wellness

Financial wellness refers to your relationship with money and how it affects your life. Both your financial management skills and mindset are equally important as your income. Achieving financial wellness involves reducing ongoing financial stress. It means understanding your financial situation and having a solid strategy to manage it effectively. By prioritizing your overall wellbeing and striving for financial wellness, you can create a more balanced and fulfilling life.

Read more about why is financial wellness important for our overall health →Saving

Having emergency savings is crucial; without it, an unexpected car repair or sudden job loss can force you into debt and hinder your progress toward achieving your financial goals

Learn more about Neontra's free financial health checks and emergency funds scorecard →Serious stuff

The Link Between Health and Financial Well-Being

Financial well-being can impact nearly all areas of your life, including your physical and mental health →Serious stuff

Posthaste: More Canadians improving financial wellness as costs climb by Ben Cousins

Ninety-one per cent of respondents have taken at least one measure to improve their financial well-being →Serious stuff

“How we handle our finances is very much tied to how we experience life,” says John Pharr, CPA, a tax and financial advisor based in Pensacola, Fla. “Our spending, saving, and money management habits reflect our psychological health. By getting a handle on them, we can dramatically reduce our worry and anxiety and regain a sense of control.”

How to fix your finances: 6 tips for financial wellness in 2025 →Serious stuff

Frugal Festivities: Budget-Friendly Ways for Students to Celebrate the Holidays by Khanysha Coppin

For the budget-conscious student, here is a list of tips, tricks and money-saving ways to enjoy your holiday season and take part in other outdoor winter activities →Serious stuff

Tips For Financial Wellness This Holiday Season

The holidays are an exciting time, characterized by family fun, delicious food, and overspending... →Budgeting

12 Tips To Build A Holiday Budget That Won’t Break The Bank by True Tamplin

Learn to allocate funds wisely while keeping holiday cheer alive →Serious stuff

How can Canadians achieve financial wellness?

With science-based tools, new research suggests roadmap to recovery for financially stressed Canadians →Serious stuff

36-year-old mom making $10,000 a month in passive income: The 3 books that helped me get rich and ‘live life on my terms’ by Rachel Himenez

These are the three books that shifted her mindset about money, helped her build wealth →Serious stuff

Is Sports Betting The New Threat To Your Financial Wellness? by Cyrus Purnell

The mixture of sports betting with the 24/7 access of a mobile phone can be a pernicious mixture →Word of the week

Credit Union

A credit union is a nonprofit financial institution owned by the people who use its financial products (members). Credit union members can access the same products and services offered by a traditional bank, such as credit cards, checking and savings accounts, and loans.

Almost 11 million Canadians trust their local credit union for their day-to-day banking find one here →Serious stuff

The Credit Union Difference: Why Canadians are Choosing Credit Unions to Reach their Financial Goals

Here are just a few of the reasons that close to 11 million Canadians love banking with a credit union →Serious stuff

Top 4 Tips to Improve Your Financial Wellness by Ashley Redmond 1) Budget Strategically 2) Have an Emergency Fund 3) Stay on Top of Taxes 4) Goals

Use these tips from Ashley Redmond to help keep your financial future on track →Word of the week

The Diderot Effect

The Diderot Effect states that when we acquire a new possession, it often leads to a cycle of acquiring even more new items. As a result, we end up buying things that our past selves never needed in order to feel content or happy.

The Diderot Effect: Why We Want Things We Don’t Need — And What to Do About It by James Clear →Serious stuff

Making financial decisions – including around budgeting, taking out loans or investing – can be daunting, and many college students feel ill-equipped to do so.

Financial Literacy: What College Students Need to Know by Sarah Wood →Quote of the week

"Money, like emotions, is something you must control to keep your life on the right track."

- Natasha Munson

Serious stuff

Financial literacy is one of the most important skills you can develop in your life, but it can often be daunting and overwhelming. There is a new free Financial Literacy course on Khan Academy. From understanding interest rates to navigating the stock market, this course breaks down complex concepts into easy-to-understand lessons that will empower you to take control of your money.

Take your finances to the next level with the practical tips and step-by-step guidance from Khan Academy →Budgeting

Budgets are the building blocks of financial stability

- Automate bill payments

- Create a “wants list” to curb overspending

- Use cash or a debit card for your problem spending areas

- Sock away funds for emergencies

- Get realistic with sinking funds

- Save on homeowners and auto insurance

- Gulp your daily “budget smoothie”

- Budget with your partner

- Use a free budgeting app like Neontra

Serious stuff

Financial stability does not always mean wealth, but financial sufficiency as defined by each person. In order to build financial stability, it normally takes time to collect enough funds for general living in the future and emergency incidents that may occur.

7 Steps to financial stability by CHUBB →Word of the week

Financial Resilience

Financial resilience is the ability to withstand life events that impact one's income and/or assets.

Steps Toward Financial Resilience →Infographic of the week

The Challenge That Financial Vulnerability Brings to Canadians

Financial vulnerability and financial stress are mainstream issues affecting Canadians of all income levels and in particular more vulnerable populations.

Free Financial Resilience Score Tool →

Free Financial Resilience Score Tool →Serious stuff

Ontario students will soon be required to pass a financial literacy test as part of a number of changes coming to the requirements needed to earn a high school diploma. Education Minister Stephen Lecce says students will learn home economics such as managing a household budget and how to protect themselves against financial fraud. He says students will need at least 70 per cent on the financial literacy test in order to graduate and it will first be offered in Grade 10 math.

Ontario requiring high school financial literacy test by The Canadian Press →Serious stuff

Financial wellness tips to help improve your financial future

Get ahead and learn how to improve financial wellness through simple spending, saving and budgeting tips →Serious stuff

Canadian resources to help improve your financial well-being 1) Budgeting and money management 2) Paying down your debt 3) Smart ways to save 4) Protecting yourself 5) Income taxes and you 6) Planning for retirement 7) Multimedia and interactive resources 8) Financial wellness at work

Use these helpful resources to find more information on the topics that matter to you here →Serious stuff

Key Strategies for Improving Your Financial Wellness By Terry Turner and Thomas J. Brock, CFA®, CPA

You can enhance your financial wellness by improving various aspects of your personal finances →Serious stuff

All About Financial Wellness: How It Affects Your Health, and Tactics to Achieve It By Christine Byrne, MPH, RD, LDN

Read on for more about what financial wellness is, what contributes to it, and how to boost your own →Serious stuff

According to the American Psychological Association (APA), 72% of adults report feeling stressed about money, whether it's worrying about paying rent or feeling bogged down by debt.

Financial Stress: How to Cope By Elizabeth Scott, PhD →Serious stuff

Feeling overwhelmed by money worries? Whatever your circumstances, there are ways to get through these tough economic times, ease stress and anxiety, and regain control of your finances.

Coping with Financial Stress →Infographic of the week

FP Canada™ 2024 Financial Stress Index

The 2024 Financial Stress Index reveals that money continues to be the top stressor for Canadians (44%), steadily increasing from 2023 (40%) and 2022 (38%)

Year-over-year, the Financial Stress Index shows that working with a financial professional, such as a CFP® professional or a QAFP® →

Year-over-year, the Financial Stress Index shows that working with a financial professional, such as a CFP® professional or a QAFP® →Serious stuff

What to Do If Your Partner Is Bad With Money

An expert weighs in on how to navigate this tricky situation →Serious stuff

Financial wellbeing is learning how to manage your money and resources responsibly with an eye toward long-term financial security.

Explore resources to improve your financial wellbeing →Serious stuff

Financial wellness means having a comfortable sense of financial security and having enough money to meet all needs and demands in your life.

What is financial wellbeing? →Saving

Savings Goals: How To Set And Achieve Them by Bonnie Honeycutt

Whatever your reasons, having a savings goal—and not losing sight of it—will help you reach it →Serious stuff

Learn what financial wellness is, why it's important, and how it can improve your overall well-being. Plus, 10 tips to guide and improve your financial wellness.

Financial wellness: what it is, benefits, and 10 ways to get there →6 tips to help you get the most out of your health insurance plan by Selena Simmons-Duffin, Andee Tagle

- Read your plan's coverage documents, every year – even if you think you know what they say

- Find yourself a good primary care doctor

- Take advantage of preventive care

- Plan the timing of procedures strategically

- Learn how to file a claim

- Don't miss out on perks

Serious stuff

Top 10 Most Common Financial Mistakes By Emily Morris

The most common financial mistakes that often lead people to major economic hardship →Infographic of the week

A Map of Global Happiness By Country in 2024

Happiness, like love, is perhaps one of the least understood and most sought-after emotions and experiences in human life. And while many inspiring teachings exist about attaining individual happiness, it’s worthwhile to consider how happy entire countries are on a collective scale.

A Map of Global Happiness By Country in 2024 →

A Map of Global Happiness By Country in 2024 →Serious stuff

Financial Wellness: what it is, benefits, and 10 ways to get there

Learn what financial wellness is, why it's important, and how it can improve your overall wellbeing →Serious stuff

The 7 levels of financial freedom, according to a millionaire — 50% of U.S. workers are at Level 2 by Ryan Ermey

What level are you? The 7 levels of financial freedom →Serious Stuff

Wellness is a concept that has found its way into more and more corners of American life.

At its heart, wellness is about adopting practices—like exercising more and eating healthy—that help you live a better life.

These practices can also help you improve your financial life, under the rubric of “financial wellness.” This concept is about changing financial behaviours and adopting more effective money habits to secure financial stability and financial freedom.

Saving

Tips to visualize your way to better money management by Emma Edwards

Visualization can help you develop positive money habits and set you up for financial success. →Serious stuff

Dr. Aditi Nerurkar offers five accessible ways to minimize stress in your daily life — no lavish vacations or big life changes necessary.

NPR LifeKit: 5 simple ways to minimize stress →Saving

We're supposed to do things routinely for our health, like brushing our teeth, showering and exercising. And there are basic hygiene tasks to maintain your financial health too. Here are five tasks to tackle each year.

NPR Life Kit: Start a financial self-care routine →

NPR Life Kit: Start a financial self-care routine →Serious stuff

The Connection Between Financial Well-Being And Mental Health

Paula Thielen on how to empower people for both financial security and mental health →Budgeting

If you’re looking to create a personal budget, start with these six steps

- Calculate your net income

- Track your spending

- Set realistic goals

- Make a plan

- Adjust your spending to stay on budget

- Review your budget regularly

Did you know?

Average household earnings in 2022 were $94,003, while average total expenditures for the year were $72,967, according to the Bureau of Labor Statistics' Consumer Expenditure Survey.

American Households' Average Monthly Expenses: $6,081 →Budgeting

7 tips to save money on family expenses from Discover

- Focus on food costs

- Keep birthdays simple

- Give secondhand a chance

- Choose frugal fun

- Plan ahead for the holidays

- Hack your housing costs

- Talk budgeting and saving with your kids

Serious stuff

Gen Z, millennials say money talks should happen before the relationship gets serious, study finds

Ana Teresa Solá explores navigating big feelings when financial planning with a partner →Word of the week

Permanent Life Insurance

Permanent life insurance gives you lifetime coverage. If you pass away while your insurance policy is still in force, your beneficiaries will receive a death benefit. Permanent life insurance policies usually build up a cash value. You will get your money back if you decide to terminate your coverage. The amount would be less than what you spent in insurance premiums.

You can easily track all your life insurance policies at Neontra →Budgeting

When to make a budget:

- Significant changes in your personal life

- Job status has changed

- When you don't know where your money is going

- Find it difficult to save regularly

- Your debts are escalating

- Your feeling overwhelmed by your finances

- Feel like you’re not in control of your money and debts

- Thinking about a major purchase

Saving

How To Avoid Being House Poor And Other Homebuyer Horror Stories

Half Banked Podcast: Hosts Cadeem and Bethan focus on what buying a home is like, particularly for first-timers →

Half Banked Podcast: Hosts Cadeem and Bethan focus on what buying a home is like, particularly for first-timers →Serious Stuff

7 Ways to Manage Financial Stress from TIMEstamped

- Figure out where the money stress is coming from

- Create a budget or spending plan

- Start an emergency fund

- Increase your income

- Automate some of your financial transactions

- Improve your money communication style

- Get outside advice and help

Infographic of the week

What are people’s biggest financial stressors?

The route to financial happiness isn’t the same for everyone, though 81% of Americans agree that inflation and the rising cost of goods generate the most stress. But different trends emerge when we compare the generations.

Financial stress is such a challenge that many plan to retire three years later than planned →

Financial stress is such a challenge that many plan to retire three years later than planned →Budgeting

Four Tips For Budgeting In The Modern World from Liz Frazier @Forbes

- Don’t be scared of change

- RE-Categorize your spending

- Cut the right expenses

- Budgeting is a practice

Infographic of the week

The Happiness Index

Across generations, Americans are tending to find happiness in areas other than their finances. The financial situation is especially challenging for Gen Z and X; less than half report being satisfied with their finances.

How, then, can someone stay on the road to financial happiness? →

How, then, can someone stay on the road to financial happiness? →Did you know?

Some 56% of Americans are unable to cover an unexpected $1,000 bill with savings, according to a telephone survey of more than 1,000 adults conducted in early January 2022 by Bankrate.

Most Americans are still struggling to build solid savings accounts →Infographic of the week

How to Reach Financial Happiness

Many Americans believe that you need $1.2 million to reach financial happiness. So, it follows that 71% of Americans feel more money would solve their problems. This leaves us to wonder: how happy are Americans with their finances?

What makes people financially happy? →

What makes people financially happy? →Serious stuff

Money Anxiety Is Common, But You Don't Have to Handle It Alone

Read on to learn more about money anxiety, including key signs, causes, and tips to handle it →Infographic of the week

Retirement Planning Mistakes

According to professionals, the most common retirement planning mistakes are time-related, like outliving savings or not understanding how inflation can affect a portfolio over time. The number one mistake? According to 49% of financial planners, its underestimating the sizeable impact inflation has on the value of retirement savings.

Charted: Top 10 Retirement Planning Mistakes from the visualcapitalist.com →

Charted: Top 10 Retirement Planning Mistakes from the visualcapitalist.com →Serious Stuff

8 steps to helping children build good credit from Megan DeMatteo at CNBC Select

- Start early

- Teach the difference between a debit card and a credit card

- Incentivize saving

- Help them save early for a secured credit card

- Co-sign a loan or a lease

- Add your child as an authorized user

- Have them report all possible forms of credit

- Encourage them to apply for a student card

Budgeting

5 Tips To Fix Your Finances And Build A Budget That Works In 2024

Bernadette Joy of Forbes on five tips to help you build a budget you can actually live with in 2024 →Serious stuff

Financial Stress: How to Cope If you're worried about money, you're not alone. Money is a common source of stress for American adults.

Elizabeth Scott, PhD with tips for coping with financial stress →Budgeting

9 financial New Year’s resolutions to set now and achieve in the new year from Alexandria White

- Save more

- Improve my credit score

- Create a personal budget

- Pay off credit card debt

- Pay my full credit card balance each month

- Track my credit card applications

- Check my credit score more often

- Check my credit report more often

- Sign up for a credit monitoring or identity theft protection product

Serious stuff

A third of American adults go into debt to pay for holiday shopping

NPR's Asma Khalid speaks with LendingTree Chief Credit analyst Matt Schulz about why that happens →Saving

5 personal finance resolutions for 2024 (that you can actually keep). If your usual resolutions are “go to the gym” or “eat healthy,” don’t forget that a mindful approach to money.

Stress Test Podcast: Money management is also a ticket to improved wellness →

Stress Test Podcast: Money management is also a ticket to improved wellness →Serious stuff

How to donate to a charity with purpose and intention. Kevin Scally of Charity Navigator has some advice to help you make the right decisions. His group evaluates the effectiveness of over 200,000 nonprofit organizations.

Donating to a charity is a lot like voting for an issue you believe in — except you're voting with money →Saving

Sales Are Shams but Deals Are Real: Here’s How to Know the Difference

Wirecutter on spotting an overhyped “sale” that doesn’t provide a meaningful discount or an actual deal →

Wirecutter on spotting an overhyped “sale” that doesn’t provide a meaningful discount or an actual deal →Serious stuff

How to talk to your parents about their money. There comes a time when it's the kid's turn to take care of mom and dad. Here's how to broach this sensitive subject with your parents.

Life Kit NPR: Yes, end-of-life planning is a tough subject. How to talk to your parents about it →Budgeting

7 Budgeting Tips to Help You Save More Money from American Express

- Know Your Income and Expenses

- Tracking Expenses Is Worth the Effort

- Pay Yourself First

- Look for Small Expenditures that Add Up

- For Bigger Expenses, Think Big Picture

- Track How You’re Doing, and Adjust

- Accentuate the Positive

Serious stuff

What to Do If Your Partner Is Bad With Money

Brides.com - An expert weighs in on how to navigate this tricky situation →Did you know?

According to the latest figures from Experian, the average American has 3.84 credit cards with an average credit limit of $30,365.

Don’t let credit cards rule your life. Use our free credit card pay down calculator to help you plan for a brighter future →Budgeting

What is the 50/15/5 rule for saving?

The key takeaways to this simple plan are as follows:

Consider allocating no more than 50% of take-home pay to essential expenses.

Try to save 15% of pretax income (including employer contributions) for retirement.

Save for the unexpected by keeping 5% of take-home pay in short-term savings for unplanned expenses.

You'll have 30% of your take-home pay left over for discretionary spending. That might include shopping, dining out or entertainment.

Serious stuff

Author Tammy Lally encourages us to break free of "money shame" and shows us how to stop equating our bank accounts with our self-worth.

TED.com - Let's get honest about our money problems →Saving

Many millennials and Gen Z’s have done everything “right” - they’ve graduated, found good jobs, are paying off their debt and saving money. So why is it so hard to live the middle class lifestyle their parents and older peers had at their age?

Podcast: Stress Test by columnist Rob Carrick - Is the middle class dead for millennials and Gen Z? →

Podcast: Stress Test by columnist Rob Carrick - Is the middle class dead for millennials and Gen Z? →Infographic of the week

World Risk Poll: How Long Can People Survive Without Income?

In the wake of natural disasters or economic shocks, a person could quickly be left without income, which is why financial security is such an important aspect of resilience. The Lloyd’s Register Foundation partnered with Gallup and polled 125,000 people from 121 countries, asking how long people could cover their basic needs without income

How Long Can People Survive Without Income? Assessing Financial Security →

How Long Can People Survive Without Income? Assessing Financial Security →Serious stuff

Khan Academy has a great free financial literacy course. From understanding interest rates to navigating the stock market, this course breaks down complex concepts into easy-to-understand lessons that will empower you to take control of your money.

Khan Academy Financial Literacy Course created by Sal Khan →Budgeting

Budgeting Tips - Incorporate only attainable income - Be reasonable with your spending - Keep an eye on your purchasing patterns - Regularly review your budget - Avoid using credit cards - Stay positive

Start building a better future with a budget today →Serious Stuff

Teaching your kids about finances is incredibly important.

Here are 11 Financial Words all parents should teach their kids, according to Forbes:

- Saving(s): Age 4+

- Budget: Age 8

- Loan: Age 8

- Debt: Age 8

- Interest: Age 8-10

- Credit/Credit Card: Age 8-10

- Taxes: Age 10-12

- Investment – Age 10-12

- Stock – Age 12+

- 401(K)/RRSPs: 14+

- Credit Score: Age 15+

Saving

Dear Life Kit: My husband shuts down any time I try to talk about our finances

Podcast: NPR Life Kit on talking about money with your partner →

Podcast: NPR Life Kit on talking about money with your partner →Serious Stuff

How to deal with money struggles during a financial crisis:

Navigating a financial crisis can be overwhelming.

- How do you decide what expenses should be prioritized?

- Should you tap into your retirement accounts?

- What about asking friends or family for financial help?

- Should you apply for a payday loan?

The first step of creating your emergency plan is understanding your essential needs.

Saving

Love in the time of inflation: How to manage rising costs when dating

Podcast: Stress Test by columnist Rob Carrick on creative ways to meet the love of your life - while spending less →

Podcast: Stress Test by columnist Rob Carrick on creative ways to meet the love of your life - while spending less →Serious stuff

Fifty Money Questions to Ask Your Partner

Use these 50 questions across four categories to jumpstart the conversation. →Budgeting

Building a budget helps you manage how you spend your money. When you control your spending, it’s much easier to achieve your financial goals, whether that is to save, pay off debts or simply live within your means.

Building a Budget: Helpful Tips for Students →Saving

Investing against climate change - Climate change is a growing concern for many young Canadians, with some questioning where they should live, what they should be saving for and how they should invest.

Podcast: Stress Test by columnist Rob Carrick - How climate anxiety is shaping small and large financial decisions →

Podcast: Stress Test by columnist Rob Carrick - How climate anxiety is shaping small and large financial decisions →Serious stuff

You might not realize it, but there is something called financial personality, and it can play a big role in your ability to handle and manage money.

How Your Personality Is Affecting Your Finances →Investing

Investing Introduction

Whether you are new to investing or new to Canada, investing for your future is important.

Investing for your future →Serious stuff

4 Common Money Philosophies (And What They Say About You). Struggling with your finances? Your deepest-held beliefs about money might be to blame.

Which Script Do You Follow →Serious stuff

In 2021, 24% of people aged 15 to 49 had changed their plans with regard to having children as a result of the COVID-19 pandemic. Most often, they planned on having fewer children or having a child later.

Family Matters: A new addition to the family? It depends →Word of the week

Essential Expenses

These are expenses that are necessary. Another way to identify these expenses is to determine if they are 'needs' rather than 'wants'. Essential expenses might include: - Rent/Mortgage - Groceries - Utilities - Medical Expenses Unlike, restaurants, and entertainment, that are 'wants' or non-essential expenses and do not need to be made.

Follow every dollar - Track and analyze your non-essential expenses →Infographic of the week

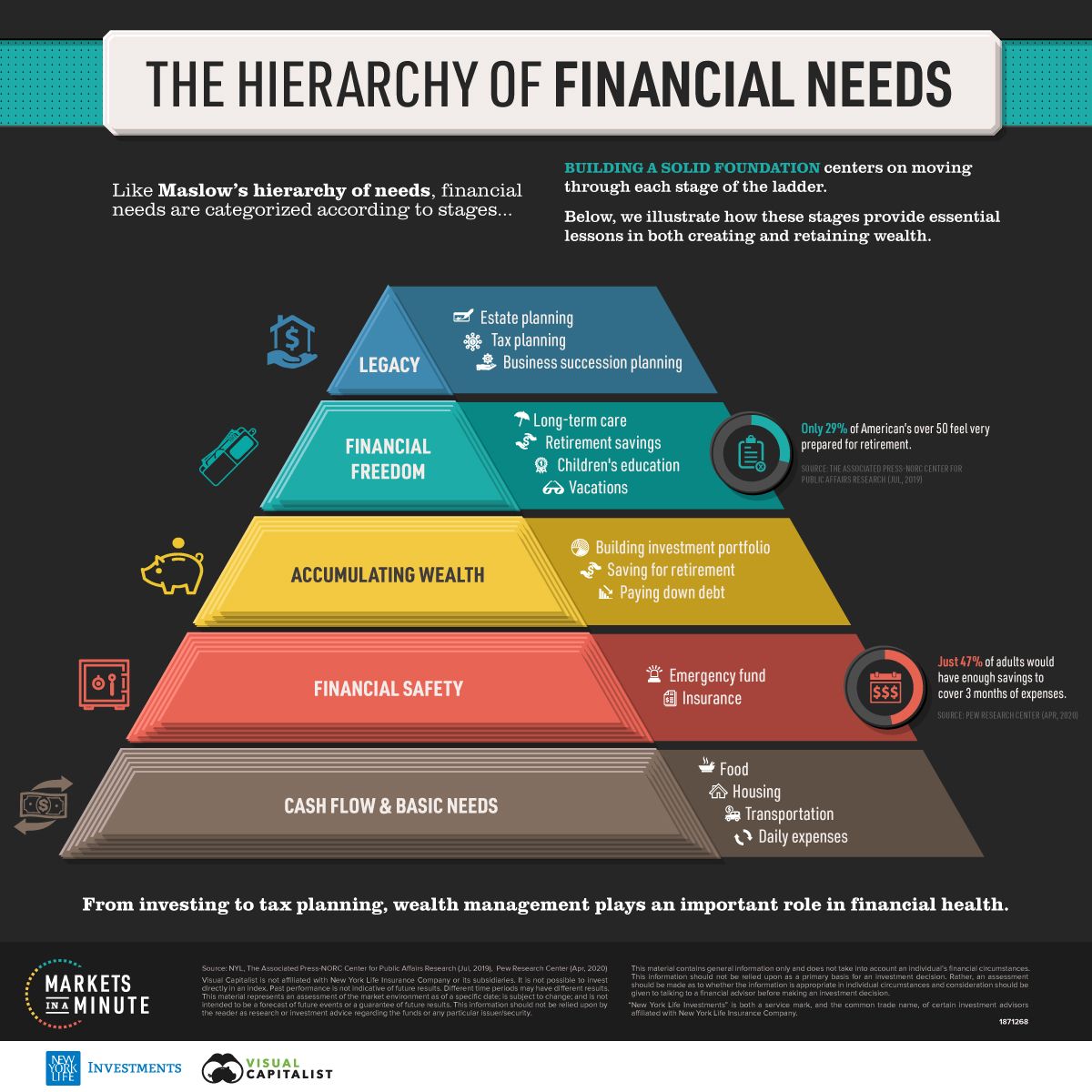

Visualizing the Hierarchy of Financial Needs

Behavioural scientist Abraham Maslow wrote “A Theory of Human Motivation” in 1943, arguing that humans worldwide are influenced by a “hierarchy of needs”. This theory organizes human needs across five levels, where needs in the lower end must be satisfied before progressing onto the next level.

See the steps to creating a strong financial foundation →

See the steps to creating a strong financial foundation →Saving

Rob Carrick talks to Paul Kershaw, a professor at the University of British Columbia and founder of Generation Squeeze, a group that researches intergenerational fairness, about why many millennials feel like the middle class is dead.

Podcast: Is the middle class dead for millennials and Gen Z? →

Podcast: Is the middle class dead for millennials and Gen Z? →Serious stuff

Learn the 101 of financial literacy with a fun, dynamic guide that makes money feel empowering, financial literacy becomes a life-long habit that pays dividends.

Financial literacy 101 from the Canadian Foundation for Economic Education →Infographic of the week

Visualizing Annual Working Hours

Comparing the number of hours people work in different countries can provide insight into cultural work norms, economic productivity, and even labor laws.

Where does Canada rank? How do your working hours compare? →

Where does Canada rank? How do your working hours compare? →Word of the week

Financial Literacy

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. The earlier you start, the better off you will be, because education is the key to success when it comes to money.

Financial Literacy: What It Is, and Why It Is So Important →Serious stuff

Canadians' confidence in their ability to retire on time and debt free declined between 2016 and 2022, according to a new research report released by the Canadian Public Pension Leadership Council (CPPLC).

Research shows Canadians losing confidence in their plans for retirement →Saving

101 Ways To Save Money

Tips for saving up for a big goal, paying down debt or cutting costs →

Tips for saving up for a big goal, paying down debt or cutting costs →Investing

Millennials: 4 Tips to Start Investing Today

1. Build your credit 2. Open a TFSA 3. Invest what you can 4. Set some goals

Here are some tips to get started from Motley Fool →Budgeting

One in four Canadians are unable to cover an unexpected expense of $500, according to StatsCan.

Budget planning can help you live a better financial life and save for unexpected expenses →Infographic of the week

Ranked: The Cities with the Best Work-Life Balance in the World

"While some careers can be relatively stress-free, maintaining a healthy work-life balance can seem impossible for many. The easy access to technology, blurred boundaries around work and personal time, and fear of job loss push many to work overtime, and fail to use vacation time or sick leave."

How did Canadian cities measure up? →

How did Canadian cities measure up? →Word of the week

Emergency Fund

This is money that's set aside as a financial safety net. Depending on how much you have saved, an emergency fund could cover long-term expenses if you lose your job or with short-term unexpected events.

Start tracking your emergency fund today →Serious stuff

"How improving your financial literacy can help ease stress in a tough economy. Brushing up on your financial knowledge can help to build confidence and freedom."

Managing money can be difficult for anyone, regardless of their financial situation →Saving

If you’re looking for solid financial-planning strategies and information about the savings tools available, this podcast is for you.

Podcast: How to crisis-proof your finances →

Podcast: How to crisis-proof your finances →Serious stuff

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other Canadians.

Financial literacy self-assessment quiz →Budgeting

You know a lot more about budgeting than you probably think. Even if you’ve never done any kind of household budgeting at all, you almost certainly already have had significant experience with it.

How To Make A Budget: 5 Time-Tested Approaches →Infographic of the week

Charting the Relationship Between Wealth and Happiness, by Country

Throughout history, the pursuit of happiness has been a preoccupation of humankind. Of course, we humans are not just content with measuring our own happiness, but also our happiness in relation to the people around us—and even other people around the world.

Does money really buy happiness? Let’s find out →

Does money really buy happiness? Let’s find out →Saving

Without emergency savings in place, an unexpected car repair or job loss could force you into debt and derail your goals.

Do you have 3 months’ worth of expenses in your emergency fund? See your scorecard today →

Do you have 3 months’ worth of expenses in your emergency fund? See your scorecard today →Budgeting

You know a lot more about budgeting than you probably think. Even if you’ve never done any kind of household budgeting at all, you almost certainly already have had significant experience with it.

How To Make A Budget: 5 Time-Tested Approaches →Infographic of the week

How Gen Z Feels About Its Financial Future

Gen Z is an optimistic and driven generation. Many young people in this generational cohort are turning to entrepreneurship and side hustles as a way to supplement their income and build a brighter future.

Gen Zers have a more positive outlook on their financial well-being than their millennial or Gen X peers →

Gen Zers have a more positive outlook on their financial well-being than their millennial or Gen X peers →Serious stuff

SMART financial goals help you identify exactly what you want and how you plan to achieve it. SMART goals are: - Specific - Measurable - Achievable - Relevant - Time-Based

Start setting SMART goals and track your progress over time →← Curating the web to find the most interesting and helpful information about your money.