Personal Finance

Financial Wellness Starts Here

Topic: "Money Management"

← Curating the web to find the most interesting and helpful

information about your money.

Investing

Five Principles of Successful Investing

1. Invest early 2. Invest regularly 3. Invest enough 4. Have a plan 5. Diversify your portfolio

Five basic principles on how to invest and avoid costly mistakes. Learn more from RBC →Budgeting

12 Tips To Build A Holiday Budget That Won’t Break The Bank by True Tamplin

Learn to allocate funds wisely while keeping holiday cheer alive →Infographic of the week

Visualizing the Decline of the Canadian Dollar

The Canadian dollar has fallen to its lowest level in years. In late October, the loonie dropped below 72 cents USD for the first time since 2020. This graphic highlights the USD to CAD exchange rate from 2004 to 2024, based on data from the Bank of Canada Daily Noon Exchange Rate.

Over the last 20 years, the Canadian dollar has experienced notable fluctuations →

Over the last 20 years, the Canadian dollar has experienced notable fluctuations →Saving

7 common banking fees

- Monthly maintenance/service fee

- Out-of-network ATM fee

- Excessive transactions fee

- Overdraft fee

- Insufficient fund fee

- Wire transfer fee

- Early account closing fee

- Bottom line

Saving

10 Tips for Achieving Financial Security By Investopedia

- Start Saving As Soon As You Can

- View Savings Deposits As a Bill

- Save in a Tax-Deferred Account

- Diversify Your Portfolio

- Consider All Potential Expenses

- Retirement Savings Is a Must

- Periodically Reassess Your Portfolio

- Optimize Your Expenses

- Consider Your Spouse

- Work With a Financial Planner

Saving

To Tip Or Not To Tip? A Debate on Tipping Culture in Canada By Half Banked

Tune in for a dive into tipping culture — and find out how both sides, server and restaurant owner, see it →

Tune in for a dive into tipping culture — and find out how both sides, server and restaurant owner, see it →Serious stuff

All About Financial Wellness: How It Affects Your Health, and Tactics to Achieve It By Christine Byrne, MPH, RD, LDN

Read on for more about what financial wellness is, what contributes to it, and how to boost your own →Serious stuff

According to the American Psychological Association (APA), 72% of adults report feeling stressed about money, whether it's worrying about paying rent or feeling bogged down by debt.

Financial Stress: How to Cope By Elizabeth Scott, PhD →Saving

Check, please! The etiquette of splitting the tab

NPR Life Kit: Chef and food writer Kiki Aranita walks us through common dining scenarios to ensure the bill is handled fairly and smoothly. →

NPR Life Kit: Chef and food writer Kiki Aranita walks us through common dining scenarios to ensure the bill is handled fairly and smoothly. →Investing

10 Tips for Successful Long-Term Investing By Investopedia

While the stock market is riddled with uncertainty, certain tried-and-true principles can help investors boost their chances for long-term success

10 tips for successful long-term investing that can help you prevent mistakes and hopefully generate some profits →Serious stuff

10 financial lessons that you need to learn as you advance through life by Jasmin Suknanan

There are some general rules of thumb we can all learn from but seek help for personalized advice →Infographic of the week

Charted: Who Has Savings in This Economy?

The Visualcapitalist visualises the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The Impact of Higher Education on Earnings and Savings →

The Impact of Higher Education on Earnings and Savings →Investing

9 Best Ways to Invest $100K from TIMEstamped

If you have $100K to invest—from an inheritance, a bonus, or a lucky lottery ticket—it provides an excellent opportunity to start (or continue) securing your financial future.

You’ll have numerous investing options, and the best one for you depends on your goals, risk tolerance, and time horizon →Did you know?

CNN found that 33% of those surveyed do not know what "annual percentage rate" means. Further, 33% also believe that mortgage lenders are required to charge all borrowers the same fees.

Neontra can help you keep track of interest rates, loan amortization, and monthly mortgage payments →Infographic of the week

Chart: The Declining Value of the U.S. Federal Minimum Wage

This graphic illustrates the history of the U.S. federal minimum wage using data compiled by Statista, in both nominal and real (inflation-adjusted) terms. The federal minimum wage was raised to $7.25 per hour in July 2009, where it has remained ever since.

Nominal vs. Real Value of the U.S. Federal Minimum Wage →

Nominal vs. Real Value of the U.S. Federal Minimum Wage →Infographic of the week

Ranked: What People Value Most in a Financial Advisor

Are advisors putting their focus where it matters? You might think that positive reviews and recommendations would be a top consideration for people choosing a financial advisor. However, other qualities appear to be much more important.

The Qualities Investors Value in a Financial Advisor →

The Qualities Investors Value in a Financial Advisor →Serious Stuff

Wellness is a concept that has found its way into more and more corners of American life.

At its heart, wellness is about adopting practices—like exercising more and eating healthy—that help you live a better life.

These practices can also help you improve your financial life, under the rubric of “financial wellness.” This concept is about changing financial behaviours and adopting more effective money habits to secure financial stability and financial freedom.

Saving

Tips to visualize your way to better money management by Emma Edwards

Visualization can help you develop positive money habits and set you up for financial success. →Budgeting

6 Tips for Eating Healthy on a Budget

- Plan Your Recipes

- Shop With a List

- Buy Frozen or Canned

- Cut Cost With Coupons

- Buy Store Brands

- Try Growing a Garden

Serious stuff

When couples move in together for the first time, many financial questions and tasks arise, leaving room for disagreement and awkwardness.

Ana Teresa Sola on financial tips for couples moving in together for the first time →Saving

Save money on streaming services. NPR TV critic and media analyst Eric Deggans shares a streaming strategy to help you get the most bang for your buck.

NPR Life Kit Podcast: Refresh your budget with these simple finance tips →Infographic of the week

Charted: Investment Preferences by Generation in the U.S.

Different generations grow up with different values and different economic realities, causing investment preferences by generation to vary across the board. The above graphic shows how different generations invest—from millennials to boomers—based on June 2023 survey data from Charles Schwab.

The Visual Capitalist: Investment Preferences by Generation →

The Visual Capitalist: Investment Preferences by Generation →Investing

Three Investing Trends for 2024 and Beyond

Longevity, decarbonization and technology disruption could provide long-term investment opportunities.

Michael Zezas of Morgan Stanley on investing trends for 2024 →Did you know?

At one time, Queen Elizabeth II appeared on at least 33 different currencies, more than any other monarch, an achievement noted by Guinness World Records.

Neontra creates a 360° view of all your $CAD, $USD, £GBP, €EUR and ¥YEN financial activities →Investing

Why work with a financial advisor

Managing your investments can be difficult. You may not be comfortable investing on your own. A professional financial advisor or planner can help you.

Choosing a financial advisor →Serious Stuff

8 steps to helping children build good credit from Megan DeMatteo at CNBC Select

- Start early

- Teach the difference between a debit card and a credit card

- Incentivize saving

- Help them save early for a secured credit card

- Co-sign a loan or a lease

- Add your child as an authorized user

- Have them report all possible forms of credit

- Encourage them to apply for a student card

Saving

So, you splurged. Now what? The urge to splurge is universal. After the bleakness of the pandemic, people are spending more on the big and little things that bring them joy.

Stress Test Podcast: Rob Carrick and Roma Luciw speaks with Shannon Lee Simmons, a certified financial planner and founder of the New School of Finance →Infographic of the week

Holiday Survival Guide

The winter holiday shopping season is the most expensive time of year for most households. This year, spending is expected to be even higher due to rising prices. This infographic helps you start planning to shop and save for the 2023 holiday season.

How to plan and save for the 2023 holiday shopping season →

How to plan and save for the 2023 holiday shopping season →Word of the week

Time Value of Money (TVM)

The idea that money that is available now is worth more than the same amount in the future is known as the time value of money, or TVM. This is due to the fact that money that is invested has the ability to grow, and the longer it is invested, the more value it will gain. Money acquired later is viewed as having less value since it has less time to increase through investments.

Model and forecast the growth of your money. Define projected growth rates & visualize likely scenarios →Infographic of the week

Visualizing the Pyramid of Global Wealth Distribution

Who controls global wealth? In 2022, the world’s millionaires held nearly half of net household wealth. Decades of low interest rates led equities and real estate values to soar, and these assets are disproportionately held among the world’s wealthiest.

The distribution of global household wealth, based on the annual 2023 UBS Global Wealth →

The distribution of global household wealth, based on the annual 2023 UBS Global Wealth →Serious stuff

6 Estate Planning Must-Haves Everyone benefits from ensuring assets and finances are managed as they wish.

Here is an estate planning checklist of items every estate plan should include →Did you know?

According to economists, coins and banknotes make up only 8% of the world's cash. The great bulk of money in circulation today is digital.

Follow every bank note & penny - Track and analyze your cash flow →Infographic of the week

The 20 Most Common Investing Mistakes, in One Chart

No one is immune to errors, including the best investors in the world. Fortunately, investing mistakes can provide valuable lessons over time, providing investors an opportunity to gain insights into investing—and build more resilient portfolios.

20 Investment Mistakes to Avoid →

20 Investment Mistakes to Avoid →Serious stuff

How to talk to your parents about their money. There comes a time when it's the kid's turn to take care of mom and dad. Here's how to broach this sensitive subject with your parents.

Life Kit NPR: Yes, end-of-life planning is a tough subject. How to talk to your parents about it →Serious Stuff

5 Easy Ways to Take Control of Your Personal Finances by Kiara Taylor of Ascend

- Budget, budget, budget

- Create an emergency fund

- Be honest with yourself

- Ask for help

- Track your progress

Infographic of the week

Charted: Retirement Age by Country

The retirement landscape can look completely different depending on what country you’re in. And charting the retirement age by country reveals a lot of differences in the the makeup of a labor force, both for economic and cultural reasons.

Exploring retirement age trends around the globe →

Exploring retirement age trends around the globe →Investing

The Golden Rules of Investing

Investing can help you meet your financial goals and the better the investment decisions you make, the more chance you have of succeeding. While nobody can make the best investment decision every single time, following these golden rules could help you to get more from your investments over the long term.

Following these golden rules could really help you to InvestSmart →Budgeting

10 Budgeting Tips to Increase Your Money Management Skills, from Rachel Dalrymple

- Identify Your Purpose

- Write Down Income and Expenses

- Follow the 50/30/20 Rule

- Practice Zero-Based Budgeting

- Plan for the Unexpected

- Develop Habits That Support Your Budget

- Utilize Budgeting Tools

- Evaluate and Adjust Regularly

- Keep It Attainable

- Run Your Household Like a Business

Word of the week

The 30% Rule

How much should you pay in rent? As a general rule, housing should be no more than 30% of your total monthly income, including utilities. The 30% rule is based on how much you can reasonably spend and have money left over for everyday expenses like food, clothes and transportation.

Neontra auto-categorizes your expenses so you can quickly see how your budget is tracking →Investing

Investing Made Simple for Beginners and Everyone Else

Managing your money for the long run can be easier than you might imagine.

The New York Times on Investing for Beginners (Paywall) →Saving

Who Should You Trust With Your Money?

Half Banked Podcast: Hosts Cadeem and Bethan break down the difference between financial advisors and planners and the red flags you should watch out for →

Half Banked Podcast: Hosts Cadeem and Bethan break down the difference between financial advisors and planners and the red flags you should watch out for →Investing

Financial advisors agree: These are the 3 best investing tips for beginners

1. Audit your finances before you even start to invest 2. Utilize retirement accounts as much as you can 3. Know you don’t have to be an expert

If you’re just getting into investing, consider these 3 tips. →Word of the week

Financial Advisor

A financial adviser is a professional that possesses the certifications, abilities and experience to help with a number of financial matters. The term's broad definition encompasses a variety of specialities and qualifications. A financial advisor may assist you in deciding how to manage your finances for long-term goals like retirement and your children's education, purchasing a home, or more immediate goals.

Choosing a financial advisor →Infographic of the week

How Long Does it Take to Double Your Money?

At first glance, a 7% return on your investment may not seem that impressive. Yet what if you heard that your money could double in roughly 10 years?

Why it Pays to Know the Math →

Why it Pays to Know the Math →Infographic of the week

The Monthly Cost of Buying vs. Renting a House in America

With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years. Americans, however, have seen similar scenarios occur since the early 1980s.

See the difference of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation. →

See the difference of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation. →Budgeting

Diving into the world of money management might feel a bit like riding down a river that’s full of twists and surprises. No need to worry - having a good plan can make this entire experience much easier.

Budgeting Tips: 5 Successful Ways to Boost Your Money →Budgeting

Understanding Bank Fees

Do you know all these bank fees?

- The number of free monthly withdrawals or transactions on your account

- Your Monthly fee

- Minimum account balance fee

- Bill payment fee

- Transfer fee

- Late payment fees

- Overdraft fee

- NSF fee

- ATM fee

- ATM network fee

- ATM non-system machine fee

Investing

Making Smart Investments: A Beginner’s Guide

- Why should you invest? - How much should you save vs. invest? - How do investments work? - How do you make (or lose) money?

See Matthew Blume of the Harvard Business Review answers →Saving

Investing against climate change - Climate change is a growing concern for many young Canadians, with some questioning where they should live, what they should be saving for and how they should invest.

Podcast: Stress Test by columnist Rob Carrick - How climate anxiety is shaping small and large financial decisions →

Podcast: Stress Test by columnist Rob Carrick - How climate anxiety is shaping small and large financial decisions →Serious stuff

You might not realize it, but there is something called financial personality, and it can play a big role in your ability to handle and manage money.

How Your Personality Is Affecting Your Finances →Serious stuff

4 Common Money Philosophies (And What They Say About You). Struggling with your finances? Your deepest-held beliefs about money might be to blame.

Which Script Do You Follow →Investing

Motley Fool outlines Warren Buffett's investing philosophy in 9 steps

1. Look for a margin of safety 2. Focus on quality 3. Don't follow the crowd 4. Don't fear market crashes and corrections 5. Approach your investments with a long-term mindset 6. Don't be afraid to sell if the scenario changes 7. Learn the basics of value investing 8. Understand compounding 9. Research and reflect

How to Invest Like Warren Buffett →Budgeting

What Is Kakeibo? Kakeibo, pronounced “kah-keh-boh,” translates as “household financial ledger.” Invented in 1904 by a woman named Hani Motoko (notable for being Japan’s first female journalist), kakeibo is a simple, no-frills approach to managing your finances.

‘Kakeibo’: The Japanese method of saving money →Infographic of the week

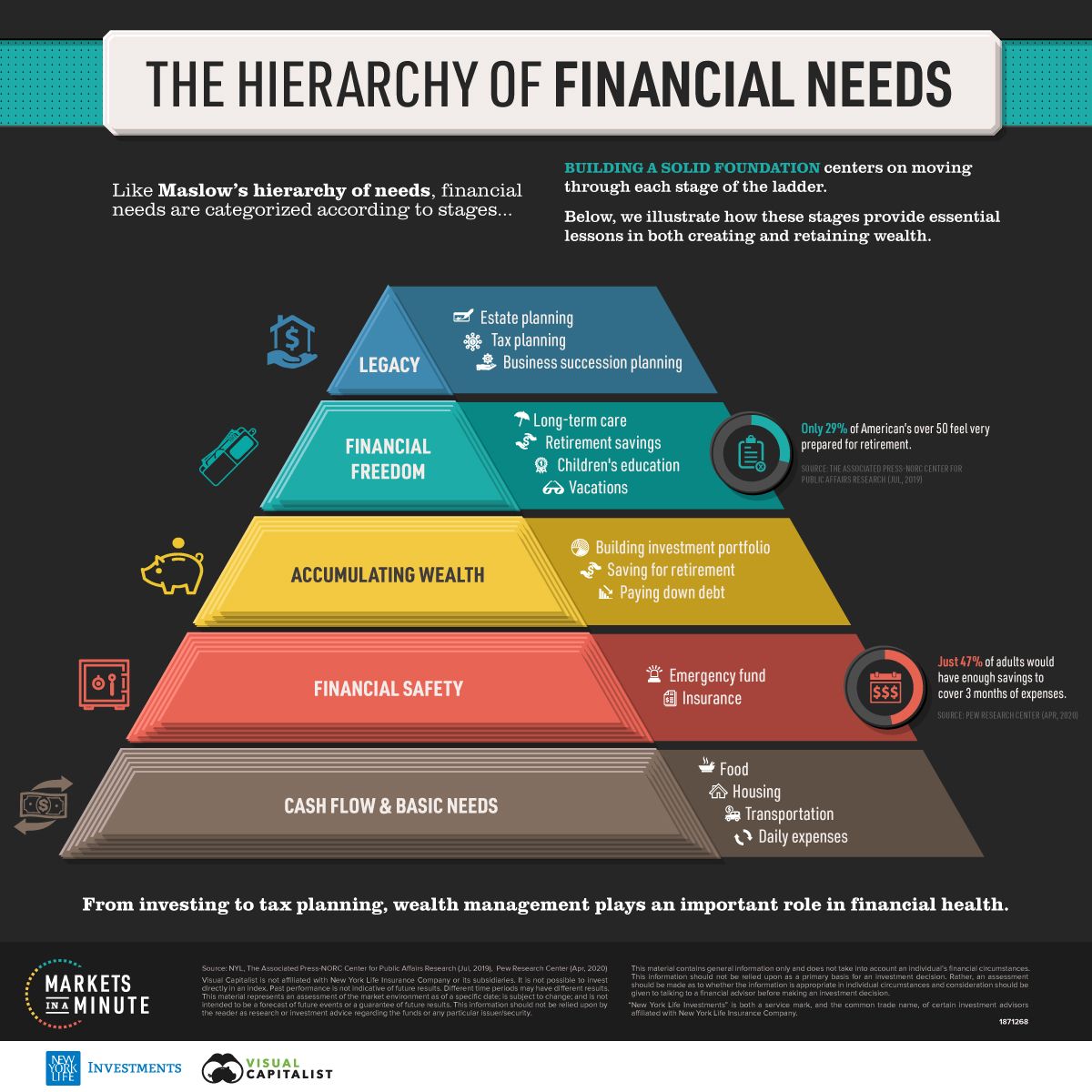

Visualizing the Hierarchy of Financial Needs

Behavioural scientist Abraham Maslow wrote “A Theory of Human Motivation” in 1943, arguing that humans worldwide are influenced by a “hierarchy of needs”. This theory organizes human needs across five levels, where needs in the lower end must be satisfied before progressing onto the next level.

See the steps to creating a strong financial foundation →

See the steps to creating a strong financial foundation →Investing

Financial advisors agree: These are the 3 best investing tips for beginners

CNBC Select shares three tips for any beginner investor just starting out. 1) Audit your finances before you even start to invest 2) Utilize retirement accounts as much as you can 3) Know you don’t have to be an expert

If you’re just getting into investing, read more →Serious stuff

Learn the 101 of financial literacy with a fun, dynamic guide that makes money feel empowering, financial literacy becomes a life-long habit that pays dividends.

Financial literacy 101 from the Canadian Foundation for Economic Education →Budgeting

Finance thinkfluencers vs economists

It turns out that there's a large gulf between the advice given by the authors of popular finance books and academic economists.

Budgeting

Non-essential costs are probably getting in the way of your financial goals. - Take-out food - Restaurants - Alcohol - Uber/Lyft instead of public transportation - Subscriptions Do you know how much you spent in the last three months?

Neontra auto-categorizes your expenses so you can quickly see where your money is going →Did you know?

Canada’s Food Price Report 2023 predicts Canadian families will spend up to $1065 more on food than in 2022.

See predictions on annual food expenditures for individual consumers based on their age and gender. →Investing

The Basics of Investing

Read about some of the most common types of investments including the Canada Savings Bond (CSB), Guaranteed Investment Certificate (GIC) and Treasury bill (T-bill).

Jargon-free investment terms →Budgeting

Why create a budget? - To accomplish a financial goal - To save money - To reduce expenses - To understand your true relationship with money better Invest the time in yourself and create sound financial practices that can last you a lifetime.

Budgeting is the first step towards financial wellness →Did you know?

The first Canadian woman to appear on a bank note was Viola Desmond. She appears on Canada's first vertical banknote issued in 2018.

Learn more about Viola and the $10 notes' unique features →Budgeting

In a 50/30/20 budget you should aim to spend your net income in this way: - 50% on your essential needs - 30% on your non-essential expenses - 20% on savings contributions/debt repayments

Neontra auto-categorizes your expenses so you can quickly see how your 50/30/20 budget is tracking →Serious stuff

Warren Buffett’s ‘secret sauce’ for investing success: Be ‘business pickers’ not ‘stock pickers’

Learn what value investing means and how it can help grow your Net Worth →Investing

Investing for Young Canadians

If you’re a young person thinking about making your first investment but not sure where to begin, you’re not alone.

RRSP, TFSA or FHSA? Young Canadians looking to invest face wide range of options →Budgeting

You know a lot more about budgeting than you probably think. Even if you’ve never done any kind of household budgeting at all, you almost certainly already have had significant experience with it.

How To Make A Budget: 5 Time-Tested Approaches →Infographic of the week

How Much Should You Tip In Each Country?

How much should you tip when traveling abroad? The answer can vary wildly depending on the country and what type of service you are using.

Servers and bartenders depend on tips to supplement wages →

Servers and bartenders depend on tips to supplement wages →Serious stuff

The Canada Pension Plan enhancement – Businesses, individuals, and self-employed: what it means for you

How does the CPP enhancement affect you →Budgeting

You know a lot more about budgeting than you probably think. Even if you’ve never done any kind of household budgeting at all, you almost certainly already have had significant experience with it.

How To Make A Budget: 5 Time-Tested Approaches →Serious stuff

Despite labour disruptions, the tax filing deadline has not changed. Canadians should take steps to ensure their return is filed by May 1, 2023, along with payment for any balance owing.

Filing dates for 2022 taxes →Budgeting

We believe financial planning should be simple, engaging and understandable for everyone.

Why is budgeting an essential personal finance tool →Serious stuff

Tax season is upon us. Find key dates including filing and payment due dates and dates for receiving credits and benefit payments from the CRA.

Due dates and payment dates →Word of the week

GIC (Guaranteed Investment Certificate)

"Guaranteed Investment Certificates (GICs) and term deposits are secured investments. This means that you get back the amount you invest at the end of your term. The key difference between a GIC and a term deposit is the length of the term. Term deposits generally have shorter terms than GICs."

Learn about the key details before buying a GIC →Budgeting

How the magic of a three-pay cheque month can give you a financial head start

There are lots of ways to play that extra payment →← Curating the web to find the most interesting and helpful information about your money.